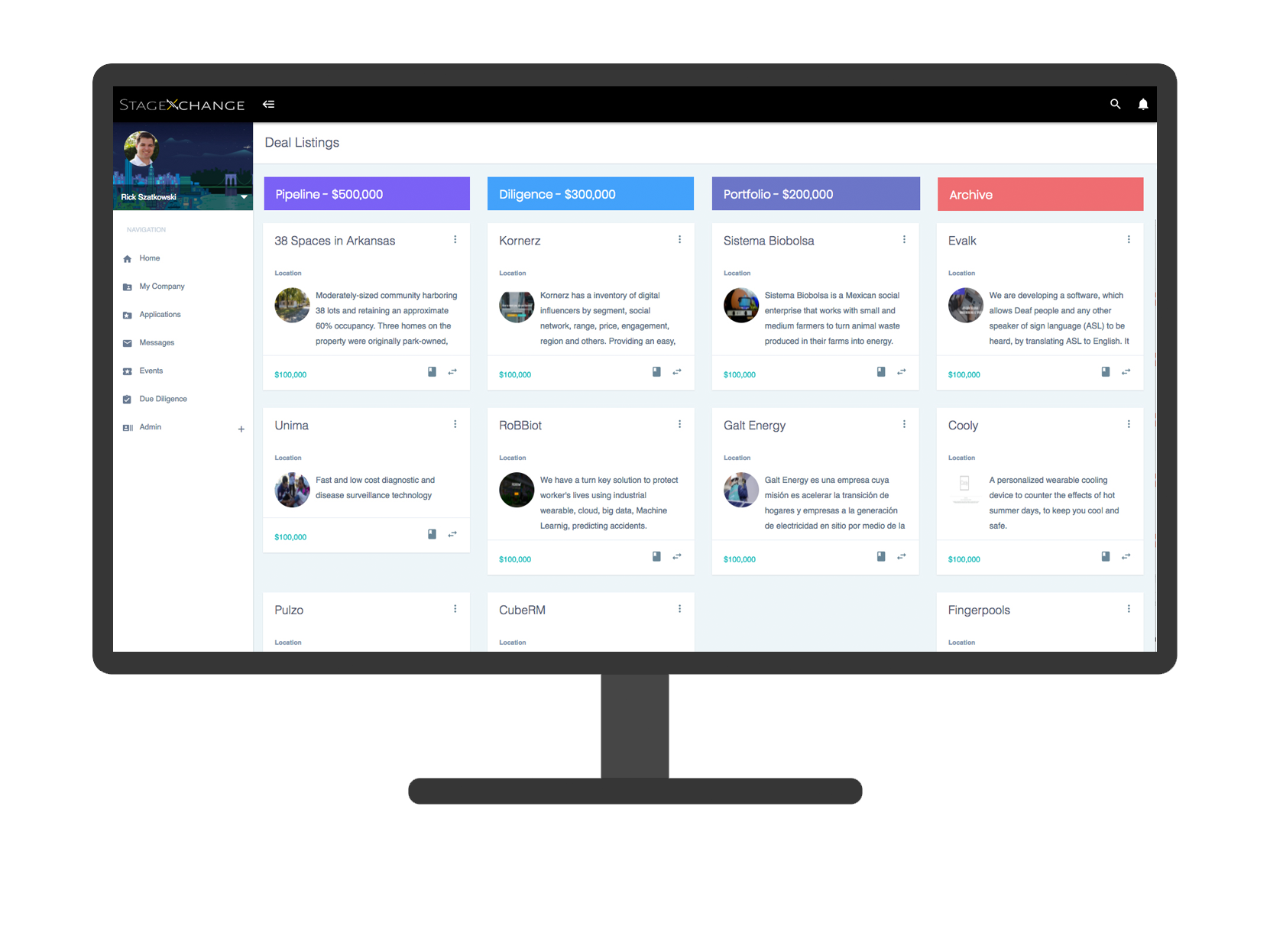

If you are like most family offices, some portion of your capital is deployed into a variety of alternative investments. Unfortunately, a lack of standardization makes managing your alternative asset portfolio a manual time consuming process. Whether your capital is deployed in private equity, real estate, or social impact ventures, StageXchange’s Portfolio Manager saves time and reduces manual tasks.

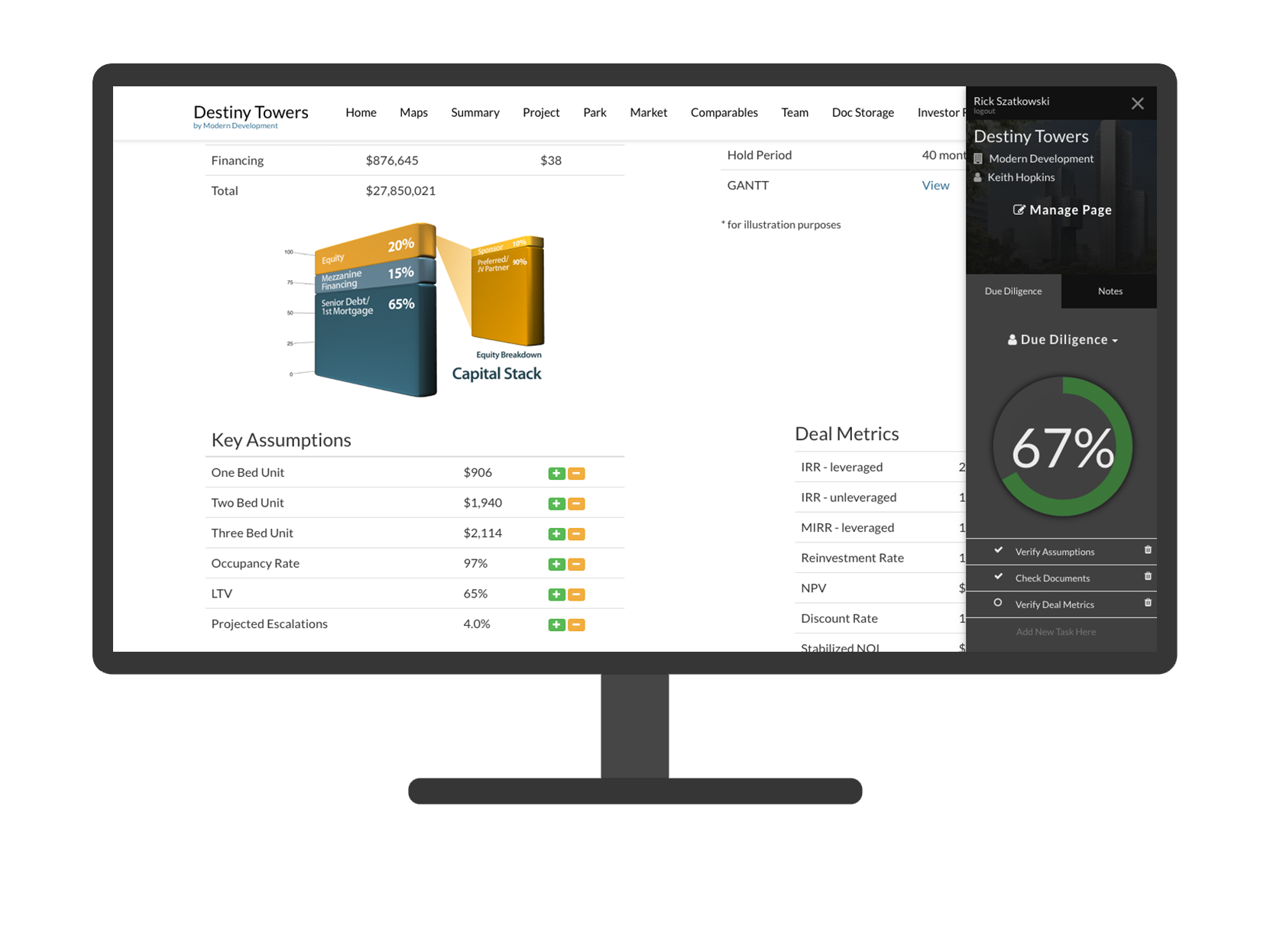

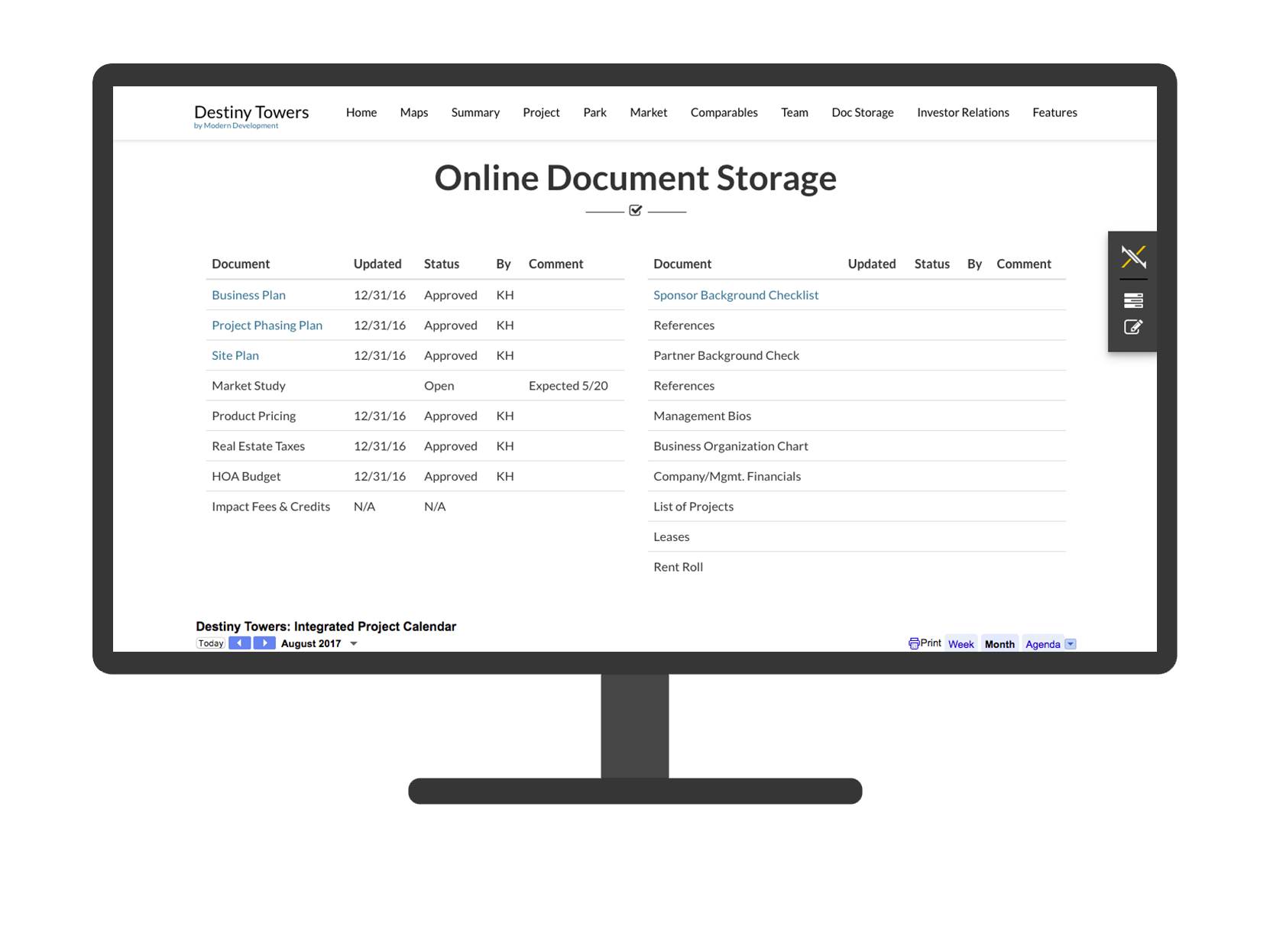

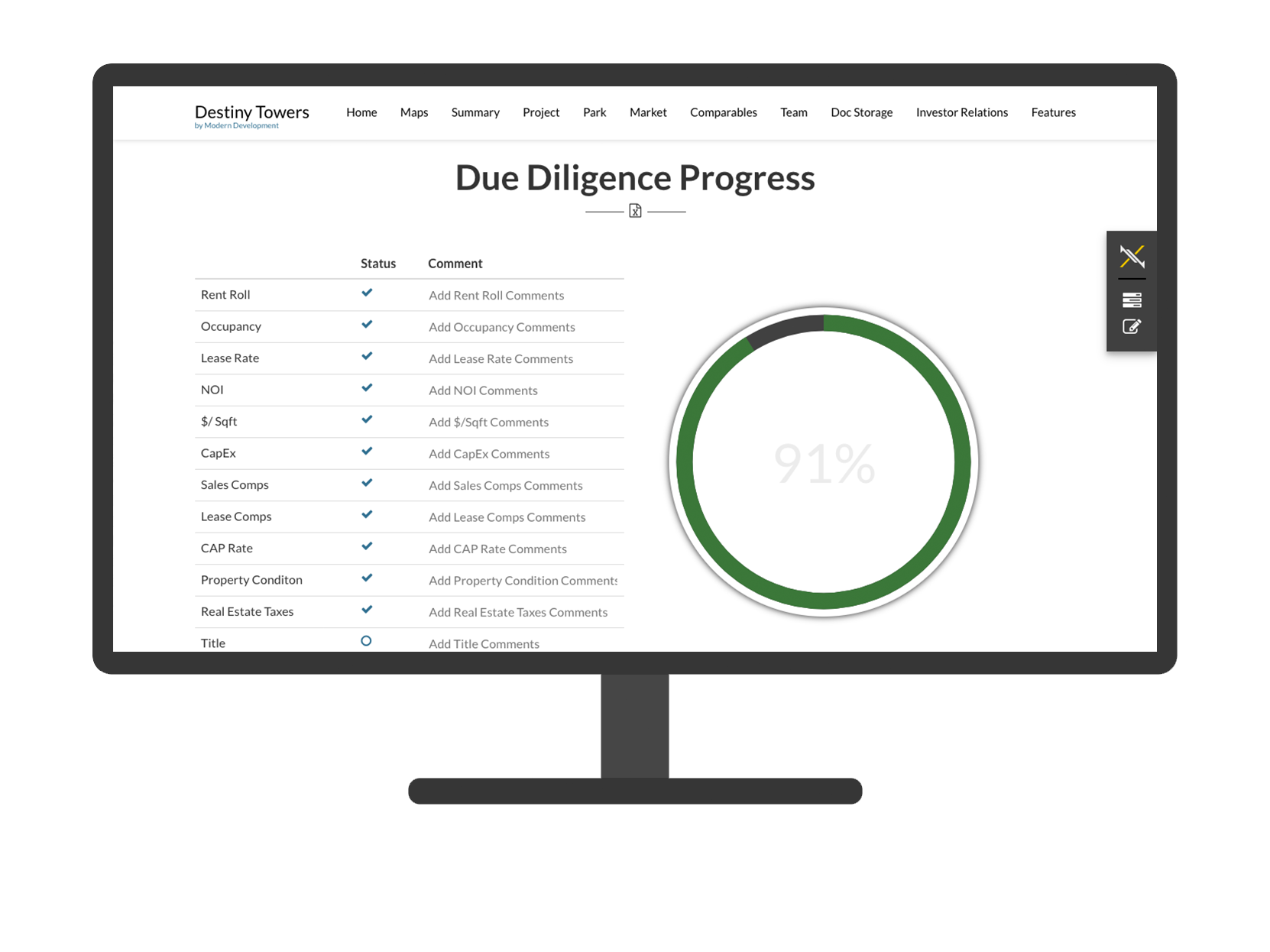

Stop wasting time piecing together the various aspects of a potential investment. Choose what information is presented to you and in what format. Lower deal risk through standardization and make it easy to collaborate with other stakeholders. With StageXchange’s Digital Deal Books, all relevant deal information is aggregated into a single interactive portal eliminating manual tasks and saving time. Leverage our technology to gain a holistic view of an opportunity. Integrate critical 3rd-party vendors to ensure you have timely accurate information. Quickly de-risk investments by stress testing key assumptions with our One-Click sensitivity tool.

The process of syndicating a private equity deal can be time consuming and cumbersome. Today sharing large amounts of confidential information with another family office is a burden. Dumping all relevant information into a Dropbox only slows the process and wastes time. By utilizing a Digital Deal Book inside your own private marketplace, you can easily share opportunities with selected parties. Embedded communication tools make it easy to collaborate with other interested parties which help to speed due diligence and eliminate redundant effort.

Here at StageXchange we believe in easing the process of deal management. From extensive due diligence to transparent pro formas, we ensure end-to-end institutional grade quality. Our unique digital deal books make it easy for developers to share their deal vision with potential investors.